The latest House of Commons Business Statistics report paints a complex picture of Britain’s entrepreneurial landscape.

After decades of growth, the number of private-sector firms has dipped, but the story isn’t one of decline. It’s one of transformation.

For small and medium-sized enterprises (SMEs), this shift signals both challenge and opportunity. Those with access to flexible, well-structured finance can use 2025’s reset moment to scale while competitors consolidate.

The Numbers Behind the Headline

As of January 2024:

5.5 million private-sector businesses (-1% year on year).

Still 59% higher than in 2000.

SMEs represent 99.8% of all firms, providing 60% of jobs and 48% of turnover.

Only 8,000 large companies (0.2%) exist, yet they generate nearly half of all business income.

Regional Picture: Uneven Recovery

London remains the capital of enterprise with almost 1 million firms, or 1,370 per 10,000 adults. Scotland saw the strongest growth (+19%), while the North West (-9%) and East of England (-7%) shrunk most.

This uneven recovery underlines how regional access to credit shapes outcomes. In areas where bank lending remains limited, agile alternative-finance providers have become lifelines for working-capital and growth funding.

Sector Breakdown: Services Still Reign

Service industries dominate the economy, accounting for 76% of businesses, 80% of employment, and 73% of turnover.

Retail: 10% of firms / 34% of turnover

Construction: 16% of firms / 8% of turnover

Manufacturing: 5% of firms / 13% of turnover

Each sector faces unique cashflow cycles:

Retailers lean on VAT & tax loans to bridge seasonal spikes.

Builders use invoice finance to release funds from staged payments.

Manufacturers deploy asset finance to modernise production lines.

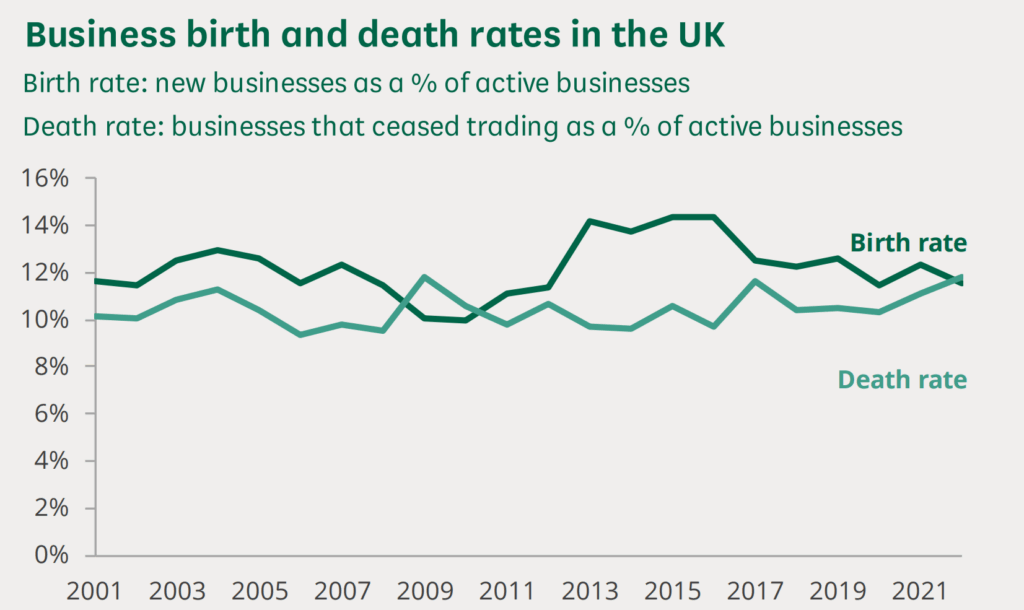

Openings vs Closures: The Warning Light

In 2022, 337,000 new businesses opened while 345,000 closed, the first negative balance since 2010.

Transport and storage led both openings and failures, showing how volatile delivery-driven sectors have become since the pandemic boom.

The drop coincides with tougher credit markets.

81% of intermediaries believed that there are gaps in the supply of finance for small businesses … the main gaps were perceived to be in early-stage, growth-stage and debt finance

Rising rates and conservative risk appetites mean many viable small businesses can’t secure funds fast enough. Those that can access invoice-based or revolving credit facilities often out-perform peers reliant on slow traditional lending.

Women and Diversity: Momentum with Room to Grow

Progress continues but headroom remains:

15% of SMEs with employees are female-led.

47% of early-stage entrepreneurs are women (up from 33% in 2018).

7% of SME employers are minority-ethnic led.

96% of FTSE 100 companies now have at least one ethnically diverse director.

Inclusive entrepreneurship is rising, yet funding barriers persist, an area where nimble non-bank lenders can make an immediate impact.

The Cost-of-Living Effect

Economic strain is another factor behind the business slowdown.

88% of business owners say their enterprise is still threatened by aspects of the cost-of-living crisis … concern on customers spending less money is up sharply from 30% to 42% over the last six months.

With households cutting discretionary spending and input costs rising, many sole traders have opted to return to salaried employment. The result: fewer active self-employed businesses and weaker start-up rates.

Here, access to short-term liquidity, rather than long-term debt, often determines whether entrepreneurs persist or pause.

Conclusion: The Age of the Agile Business

Britain’s business landscape isn’t collapsing, it’s evolving.

Those closing their doors aren’t the dreamers; they’re the ones crushed by a system that’s too slow to keep up.

The next generation of UK businesses will succeed not by being the biggest, but by being the most adaptable, and that begins with finance that moves at their speed.

Agility never comes from the high street.

It comes from partnerships built on flexibility, trust, and speed, the kind of funding approach Finspire Finance was founded to deliver.