The Illusion of Stability

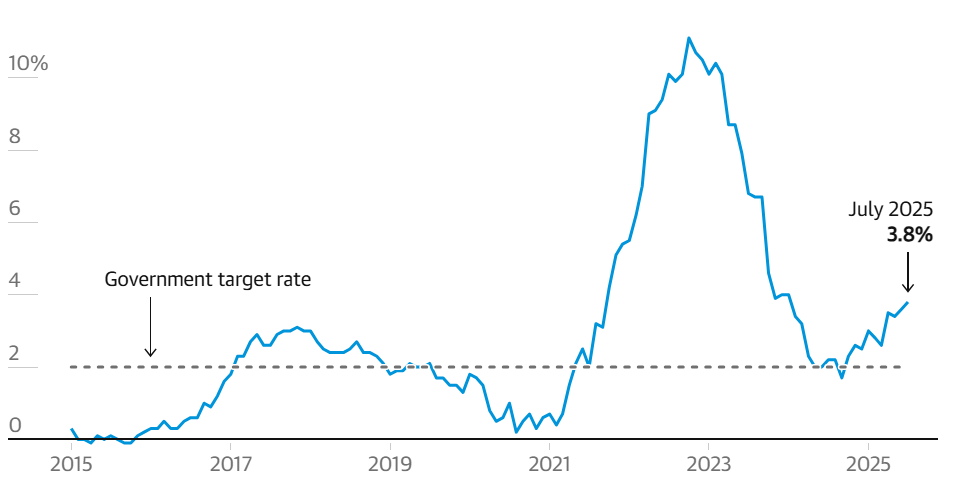

The Bank of England’s latest release puts UK inflation at 3.8% in July 2025. Policymakers present this as evidence of “stability,” and much of the media echoes the narrative that the inflation crisis is behind us.

That interpretation is dangerously simplistic. Inflation is not a single-year phenomenon, it compounds. A headline figure of 3.8% sits on top of multiple years of elevated inflation. Over the past five years, cumulative price growth has eroded almost half the pound’s purchasing power. For businesses, where input costs, energy, commercial rents and imported goods run well ahead of CPI, the real erosion is far greater. We’ve modelled them for you in this article.

It is also important to stress that the official Consumer Prices Index (CPI) is itself a blunt instrument. It measures a fixed “basket” of goods and services that bears little resemblance to the actual spending patterns of most households or SMEs. It does not adequately reflect rent inflation in major UK cities, nor the impact of shrinkflation and margin expansion by retailers. The result is that official inflation statistics understate the pressure felt by consumers, and vastly understate the pressures borne by SMEs.

For business owners, this is not an academic debate about methodology. It is the difference between growth and stagnation, resilience and decline. It is the difference between turning working capital into productive investment, or watching it silently evaporate.

How the Bank of England Measures Inflation, and Why It Misleads

The UK’s official inflation benchmark is the Consumer Prices Index (CPI). It tracks the weighted cost of a representative “basket” of around 700–750 goods and services. Each item is assigned a weight according to how much of the average household budget it represents. For example, if households spend 10% on food, food theoretically carries a 10% weight in the index. These weights are derived mainly from national accounts and survey data, and they are frequently updated, but always with a lag of around two years.

When the ONS reports inflation at 3.8% in July 2025, it means only that the basket costs 3.8% more than in July 2024. What the figure conceals is that last year’s prices were already inflated by 6%, and the year before that by 9%. Inflation is cumulative, not episodic. Successive increases build on each other, stripping away real purchasing power far faster than the headlines suggest.

CPI is also index-based, e.g. 2015 = 100. Each time the index is “rebased,” the frame of reference shifts. This has the cosmetic effect of making long-term inflation look less dramatic, because the yardstick is constantly reset. A series of 3–4% increases appears modest on paper, but in practice it translates into a 30–40% erosion in value over a five-year horizon.

The methodology itself further downplays the lived experience of inflation. CPI allows for substitution effects: if steak becomes unaffordable and consumers switch to chicken, the index assumes living standards are unchanged, but quality of life of consumers has significantly decreased. Housing costs are excluded almost entirely, with house prices ignored and rents only partially represented, despite being one of the heaviest burdens on households. Categories that spike, such as energy in 2022–23, can be reweighted downwards the following year as spending patterns adjust under duress. And in certain areas, the use of geometric-means rather than arithmetic-means has the mechanical effect of damping extreme price rises.

The ONS does not deliberately “gerrymander” its figures, but the outcome is the same: CPI produces a smoother, lower number than the real pressures faced by households and businesses. That is why official statistics often feel disconnected from reality. A reported 3–4% increase may sound tolerable, but once compounded over years and applied to the essentials of business life; imports, shipping, energy, rent – the true cost is devastating.

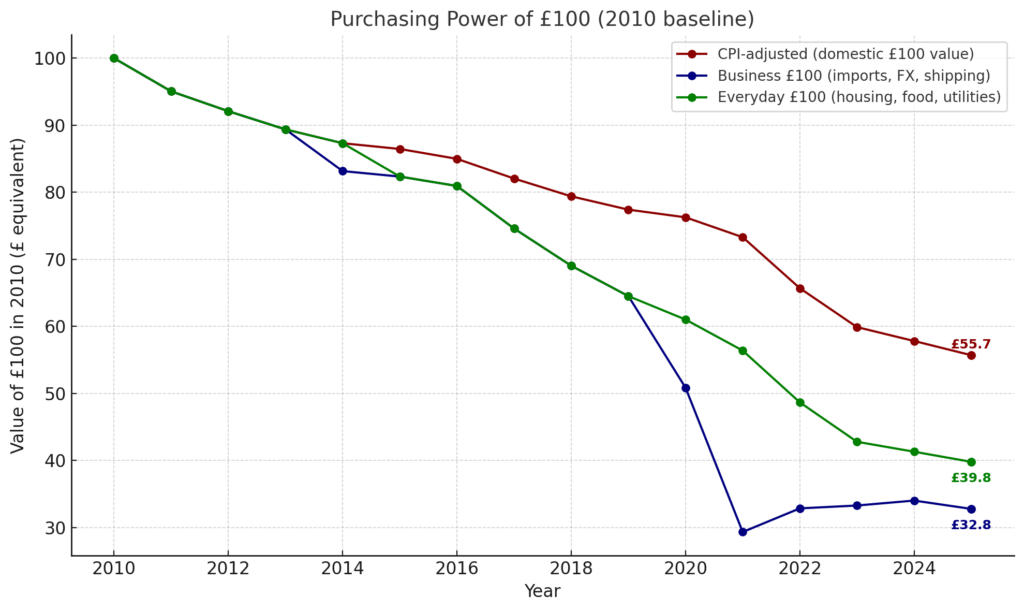

Our own modelling makes this plain. Using CPI rebased to 2010 alongside adjustments for import exposure and essential household costs, we find that £100 in 2010 is worth just £55.70 today on CPI terms. For businesses exposed to global supply chains, the figure drops to £32.80. For households weighted toward housing, food, and utilities, the figure is £39.80.

The pound you held yesterday is not the pound you think it is today, and is worth a lot less than it will be tomorrow.

The Deceptive Comfort of Inflation Graphs

When policymakers and the media present inflation data, they often use charts like the one above: a line showing the annual inflation rate rising and then falling back down. At first glance, the visual implies progress. Inflation peaked at over 10% in 2022–23, and by July 2025 it has “cooled” to 3.8%. The line has come down, and the suggestion is that the problem is easing.

But this is the great misconception. The graph shows only the rate of change, not the absolute level of prices. Prices did not fall when inflation declined. They simply rose less quickly. Goods that rose by 10% in 2022, then by 6% in 2023, and 3.8% in 2025 are not cheaper. They are cumulatively far more expensive.

This is why businesses and households feel no real relief. Even when the curve turns downward, the baseline from which you are paying is permanently higher. Each “good news” fall in the inflation rate still leaves you operating in a world where the pound in your pocket buys less than the year before.

That is why we modelled the purchasing power of the pound since 2010. Unlike the superficial comfort of a falling line on a year-on-year chart, this modelling shows the true deterioration of money. £100 in 2010 terms is now worth just £55.70 on CPI-adjusted measures, £39.80 for households exposed to rent, food, and utilities, and a mere £32.80 for SMEs dependent on imports.

If you want to see the reality of inflation, do not look at graphs of rates coming down. Look at the erosion of value over time. That is the measure that matters.

Why Stagnant Cash is the Death of a Business

Self-proclaimed “Profit-first accountants”, and ultra risk-averse business owners often argue that retained earnings and cash piles are the ultimate marker of strength. On paper, it looks prudent: build up reserves, reduce risk, and signal stability.

For lifestyle businesses where the objective is to extract dividends and sustain a comfortable income, there is some merit to this thinking. Yet even here, the danger is hidden yet very real. Flat turnover and profit, repeated year after year, means the owner is quietly becoming poorer. The same “stable” profit buys less every year. Standing still is an illusion; in reality, it is a slow retreat.

For growth-oriented SMEs, the problem is sharper still. Consider 2019 as a baseline. A cash reserve of £1,000,000 in 2019 is worth only £670,000 in CPI-adjusted terms today. Against real business costs, the effective value is closer to £500,000. Meanwhile, competitors who deployed their capital in 2019 into staff, technology, efficiency, or acquisitions have preserved and grown their market position. Those who sat on idle reserves have seen their firepower silently cut in half.

This is the flaw at the heart of amassing significant capital reserves. Filling the coffers without a strategy for deployment is only partially good advice. Unless reserves are converted into productive assets, they are not a fortress, they are a decaying liability.

Why Borrowing Can Beat Inflation

Inflation does not only erode cash; it erodes the real burden of fixed debt. For businesses, this creates a counterintuitive but powerful advantage: borrowing today can be cheaper in real terms than waiting.

A loan of £1,000,000 taken in 2019 could buy substantially more goods, stock, or equipment than the same amount will in 2025. That debt is now being repaid in pounds that have lost 30–50% of their purchasing power. Inflation itself has reduced the real cost of borrowing.

The alternative, waiting for “the right time”, is far more expensive. Goods, wages, and services are already higher. Credit facilities have not expanded in line with inflation, so they cover less. Interest rates are higher today than during 2019–21, meaning businesses are paying more for capital that buys less. Businesses who delay are punished twice: they borrow weaker money at a higher price, while competitors put earlier, cheaper debt to work.

Used correctly, borrowing is not a burden, it is an inflation hedge. Capital deployed into efficiency improvements, productive assets, or expansion today locks in value before prices climb further, while repayment occurs in depreciated currency.

In an inflationary economy, the real risk is not borrowing. It is waiting.

Why Waiting for Lower Rates is a Mistake

Many owners believe the prudent course is to hold off until the Bank of England cuts interest rates. On the surface, that appears rational: lower rates mean cheaper debt.

But the logic does not hold.

Every month spent waiting reduces purchasing power further. By the time rates eventually fall, the cost of labour, materials, and imports has already risen. And cuts are not guaranteed. Rates only decline if inflation falls back sustainably toward the 2% target, something that remains elusive. Even when cuts are delivered, they work with a lag. The damage to purchasing power has already been inflicted by the time relief arrives.

Waiting simply means borrowing “cheaper” pounds that go less far. It is a strategy of erosion, not prudence.

The Link Between QT, Inflation and Future Rates

The Bank of England is still engaged in quantitative tightening (QT), selling down its gilt holdings to withdraw liquidity. Recently, however, it has signalled a slowdown. This may seem technical, but it is anything but. A slower pace of QT means less liquidity is being drained, which in practice risks loosening conditions prematurely. More liquidity can reignite inflationary pressures, and if those pressures re-emerge, the Bank’s only option is to hold rates higher for longer, or raise them further.

The sequence is clear: less QT means more liquidity, more liquidity raises inflation risk, and higher inflation risk locks interest rates in place.

Businesses waiting for relief may find themselves waiting indefinitely.

The Pivot Back Towards QE

The Bank of England’s decision to slow QT should not be dismissed as a technical footnote. It is the first step in a well-worn sequence that leads back towards quantitative easing (QE), and with it, higher inflation risk.

The path typically unfolds as follows:

- Full-speed QT, aggressive reduction of bond holdings, liquidity drained quickly.

- Slowing QT, balance sheet still shrinking, but at a gentler pace.

- Pause, contraction stops, balance sheet stabilises.

- Reinvestment, maturing bonds rolled over, liquidity neutral.

- QE, fresh purchases, liquidity expansion, inflation pressure returns.

By slowing QT, the Bank has already entered stage two. It has eased off the brake, and history shows where that road leads.

For businesses, the implication is clear: this pivot marks the beginning of the course back towards QE. And with QE comes more money creation, renewed inflationary pressure, and the likelihood that your cash will lose value faster than you expect.

The Illusion of Fixed Credit Lines

Another blind spot for businesses is the assumption that facilities have held their value because the nominal number remains the same. In truth, those facilities have been hollowed out. A £250,000 overdraft agreed in 2020 now buys just £167,000 of goods and services. A £1 million revolving credit line in 2020 would need to be raised to £1.34 million today just to maintain parity.

If your facilities have remained unchanged year on year, you are already underfunded. You are competing with less firepower than the number suggests. This is why reviewing and resizing facilities is critical.

Contact us today, and we can assess whether your credit lines are aligned with the purchasing power you need to operate and grow in today’s economy.

From Erosion to Opportunity: The Case for Reinvestment

- The antidote to inflation is not to hoard cash but to put it to work.

- Strategic reinvestment protects and enhances value in ways idle reserves cannot.

- Expanding capacity ahead of seasonal surges secures margin against tightening supply.

- Efficiency investments in automation or digital systems permanently reduce costs.

- Well-timed acquisitions can be made at inflation-depressed valuations, while thoughtful tax optimisation ensures cash is not unnecessarily tied up in liabilities.

Every pound reinvested with purpose is a pound defended against erosion. Every pound left stagnant is a pound surrendered.

Practical Steps for Right Now

Businesses need to act deliberately.

- Start with an audit of reserves, separating essential liquidity from idle cash.

- Model the erosion those reserves will face over the next three to five years if they remain untouched.

- Review whether your overdraft or revolving credit facilities reflect today’s reality, not yesterday’s.

- Time your borrowing strategically, locking in purchasing power before it deteriorates further.

- And most importantly, partner with specialists who understand compounding inflation rather than parroting the superficial comfort of headline statistics.

Inflation is a Tax on Inaction

The evidence is clear as day. Cash is not a static asset, it is decaying liability. What looks like prudence on a balance sheet is, in practice, erosion.

The businesses that will thrive in this environment are not those boasting of “strong” cash reserves but those who deploy capital into growth before it loses further value.

Stagnant cash is not safety. It is surrender.